japan corporate tax rate kpmg

Principal International Tax KPMG US. Effective Corporate Tax Rates The effective tax rates indicated below take into account the tax deductibility of special local corporation tax and business tax payments and are calculated using the tax rates applied to a company in Tokyo whose stated capital is over JPY100 million.

Japan Highest Tax Rate 2021 Statista

2021 Global Withholding Taxes.

. Local corporation tax applies at 44 percent on the corporation tax payable. Taxation in Japan 2019. A taxable profit is defined as the generated gross income minus related expenses.

Special local corporate tax rate is 1526 percent which is imposed on taxable income multiplied by the standard of regular business tax rate. Summary of worldwide taxation of income and gains derived from listed securities from 123 markets as of December 31 2021. Per capita tax levied in a year is 4000.

Contact KPMGs Federal Tax Legislative and Regulatory Services Group at. 81 3 6229 8000 fax. Tax rates for companies with stated capital of more than JPY 100 million are as follows.

Corporation tax is payable at 232. Local management is not required. 8Corporate Tax Rate Survey 2006.

2020 Global Withholding Taxes. Changes to the controlled foreign corporation CFC regime considering the corporate tax rate reduction in the United States. Corporate tax rate in japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Insights Industries Services Events Careers About us KPMG Personalization Get the latest KPMG thought leadership directly to your individual personalized dashboard. Since then the tax practice has strived to continually provide our clients with consistent high quality service that combines among the best of our local skills knowledge and experience with the resources of KPMG Internationals global network. Today most European countries have rates.

Regular business tax rates currently apply and vary between 09 percent and 228 percent depending on the tax base taxable income and the location of the taxpayer. 81 3 6229 8000 Fax. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident.

1 202 533 4366 1801 K Street NW Washington DC 20006. OECD average is 249. While the information contained in this booklet may assist in gaining a better understanding of the tax system in Japan it is recommended that specific advice be taken as to the tax.

KPMG Tax Corporation either through your normal contact at the firm or using the contact details shown below. Local management is not required. Tax base Small and medium- sized companies1 Other than small and medium-sized companies Taxable income up to JPY8 million in a year 19 152 232 Taxable income in excess of JPY8 million 232.

KPMG Tax Corporation Izumi Garden Tower 1-6-1 Roppongi Minato-ku Tokyo 106-6012 Japan Tel. Corporate and international tax proposals in tax reform package 19 December 2018. Principal international tax kpmg us.

Share with your friends. 81 3 5575 0766. The effective corporate tax rate using Tokyo tax rates applied to a company whose stated capital is over JPY100 million is currently 3564 percent and the future tax rates will be.

81 3 6229 8000 fax. This guide presents tables that summarize the taxation of income and gains from listed securities in 115. Update on 2021 tax reform legislation.

Effective tax rate of 3086. KPMGs corporate tax table provides a view of corporate tax rates around the world. Japan Tax Update PwC 3 Enterprise tax- Non size based taxation Standard rate April 1 2016 April 1 2018 October 1 2019 Corporate Tax.

Some countries also have lower rates of corporation tax for smaller companies. KPMG Japan tax newsletterMarch 2017 4 3. Update on 2021 tax reform legislation Japan.

I added value component tax rate. Tax rates tool test page. The corporation tax is imposed on taxable income of a company at the following tax rates.

KPMGs corporate tax table provides a view of corporate tax rates around the world. Contact KPMGs Federal Tax Legislative and Regulatory Services Group at 1 2025334366 1801 K Street NW Washington. Tax reform legislation includes corporate tax measures.

Tax reform legislation includes corporate tax measures. 1Albania2006 rate 20 The corporate income tax is 20 percent of the taxable profit earned during a fiscal year January 1 to December 31. Tax Rate applicable to fiscal years beginning between 1 April 2018 and 30 September 2019.

KPMGs corporate tax table provides a view of corporate tax rates around the world. For comparison Singapores carbon tax comes in at an introductory rate of S5 RM1538tCOe until 2023 while Japans tiered carbon tax starts at 289 RM1081tCOe. 332 Corporate income taxes and tax rates The taxes levied in Japan on income generated by the activities of a corporation include corporate tax.

Tax Rate Applicable to fiscal years beginning before 1 April 2015 Tax rates for companies with stated capital of JPY 100 million or greater are as follows. Corporation tax is payable at 255 percent. Japan corporate tax rate kpmg.

The tax rate information on this page was last updated in January 2021 and the below historical tax rate data is available for. Japan tax newsletter KPMG Tax Corporatoi n. 20210906 Corporate Tax Japan Withholding tax on the payment to Foreign company Non-resident 20210901 Individual Income Tax Income tax.

KPMG in Japan was established when KPMG opened a network office in 1954. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies. Welcome to the KPMG knowledge base of research.

Taxation In Japan 2020 Kpmg Japan

Ceo Outlook Pulse Survey Insights For Tax Leaders Kpmg Global

Corporate Tax Rates By Country Corporate Tax Trends Bookkeeperbuddies Com

Survey Of Integrated Reporting In Japan 2020 Kpmg Japan

Corporate Tax Rates By Country Corporate Tax Trends Bookkeeperbuddies Com

German Rios On Twitter Corporate Tax Rates In G7 Countries Spain Ireland Singapore Http T Co Ggqyyb9h6w Twitter

Outline Of The 2022 Tax Reform Proposals Kpmg Japan

Jp Extended Tax Filing And Payment Deadlines Kpmg Global

Outline Of The 2021 Tax Reform Proposals Kpmg Japan

Updated Faqs About Work From Home Covid 19 Kpmg Japan

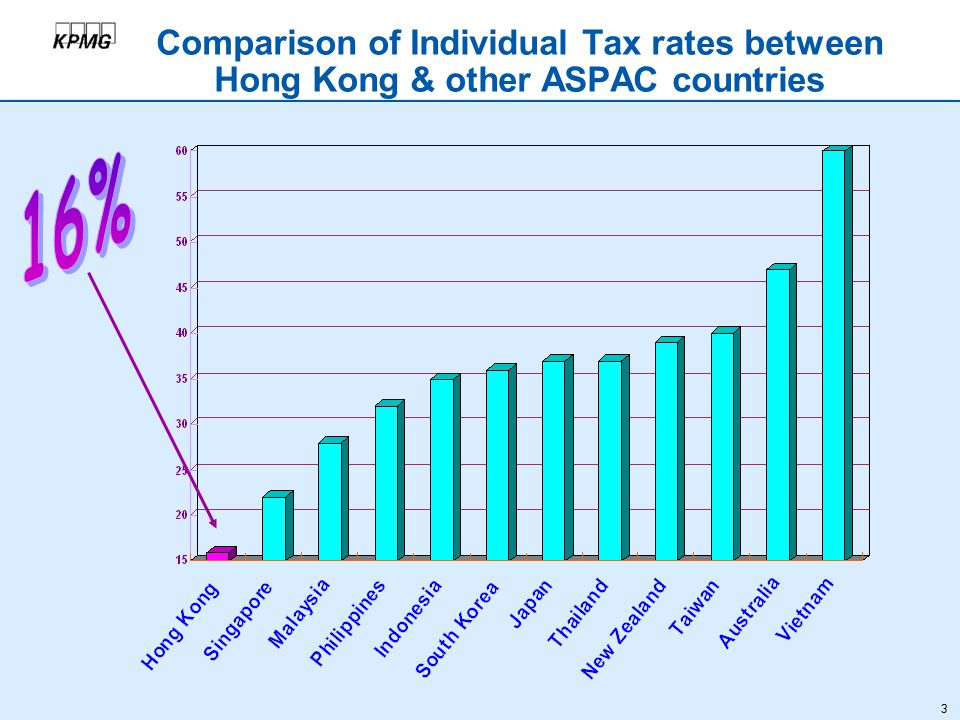

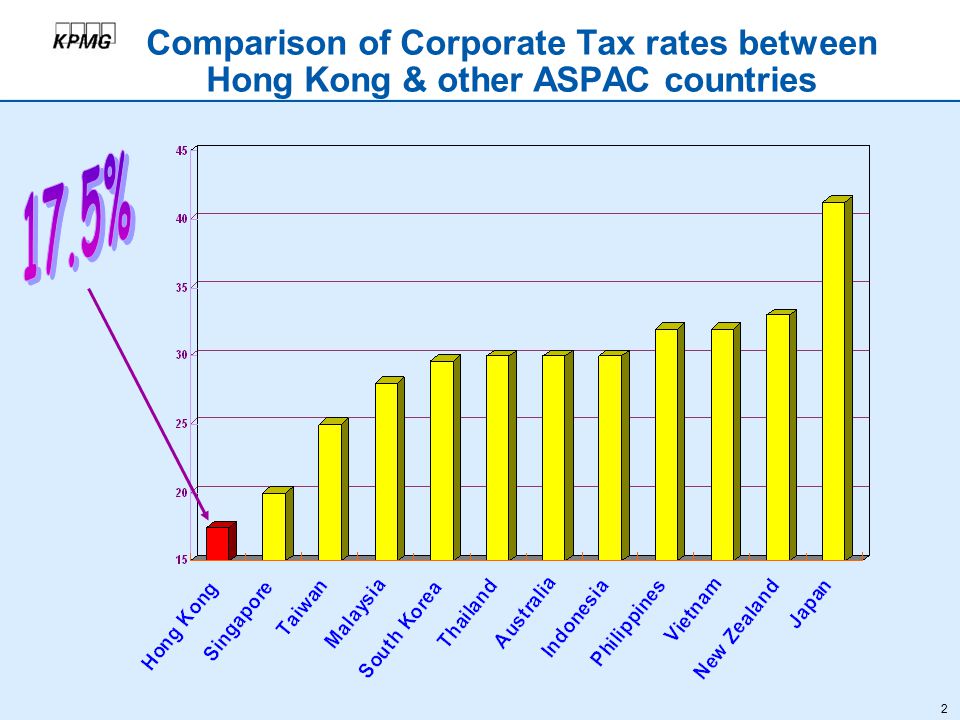

Presented By Ayesha Macpherson Tax Partner Kpmg Hong Kong Making The Best Tax Decisions For Your China Business Ventures March Ppt Download

Presented By Ayesha Macpherson Tax Partner Kpmg Hong Kong Making The Best Tax Decisions For Your China Business Ventures March Ppt Download

Jp Extended Tax Filing And Payment Deadlines Kpmg Global

Lowest Corporate Taxes In The World

U S Updates Personal Corporate Tax Change Plans Kpmg Canada

Corporate Tax Rates By Country Corporate Tax Trends Bookkeeperbuddies Com

Corporate Tax Rates By Country Corporate Tax Trends Bookkeeperbuddies Com